Estate Planning Simplified

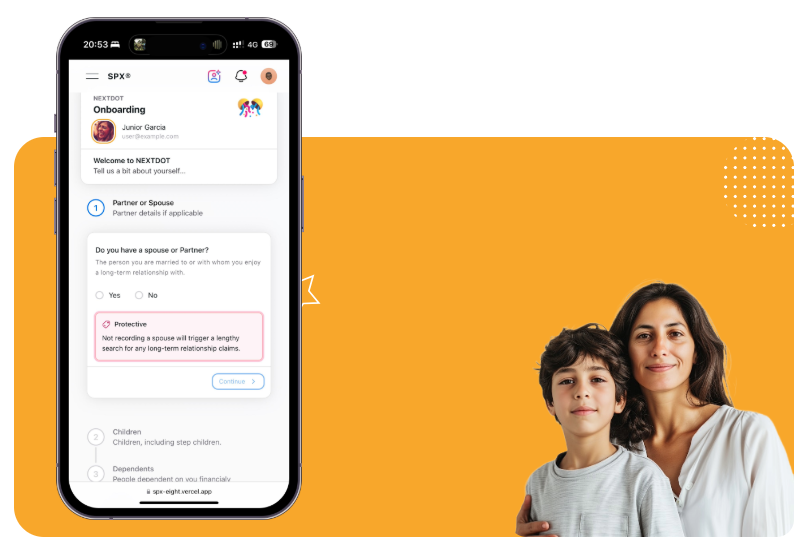

Personalized guidance tailored to each family's unique circumstances, offering clear recommendations on which documents to track, when to update them, and who to share them with.

From Overwhelmed to Organized

Like a paint-by-numbers kit transforms a blank canvas into a masterpiece, NextDot guides you step-by-step from uncertainty to clarity

Estate planning feels like staring at an empty canvas with no brush, no paint, and no idea where to start.

Lost & Confused

Which documents do I even need? Where do I start?

Anxious & Worried

What if I forget something critical for my family?

Overwhelmed & Stuck

Too many decisions, too much legal jargon, no clear path

Procrastinating

It's too complicated, I'll deal with it later...

Follow the numbered steps. Fill in each section. Watch your estate plan come together beautifully.

Clear & Guided

Step-by-step instructions show you exactly what to do next

Confident & Assured

Know you're covering everything your family needs

Organized & In Control

Simple prompts guide you through complex topics with ease

Peace of Mind

Sleep soundly knowing your family is protected

Your Estate Plan Paint-by-Numbers Kit

Remember paint-by-numbers? You didn't need to be an artist. You just followed the numbers, filled in the colors, and created something beautiful. NextDot works the same way — we've outlined the canvas, numbered the steps, and prepared everything you need. All you do is follow along, and before you know it, your family's future is secure and organized.

Get Started Now"Only put off until tomorrow what you are willing to die having left undone."— Pablo Picasso

Highlights the urgency and finality of not preparing for life's transitions. It emphasizes that putting things off can lead to leaving important tasks incomplete, which can cause significant stress and burden for loved ones.

Everything you need for peace of mind

Comprehensive estate planning tools designed to protect your family's future

Keep your family informed and organized with secure access and clear locations.

Intelligent suggestions based on your unique family situation and life stages.

Manage life events, important updates and changes to your unique family situation with regular reviews.

Explanations provide context to why each action is important, coupled with the associated risks for your family.

Choose Your Path to Peace of Mind

Whether you need step-by-step guidance or prefer to move quickly, NextDot adapts to your style

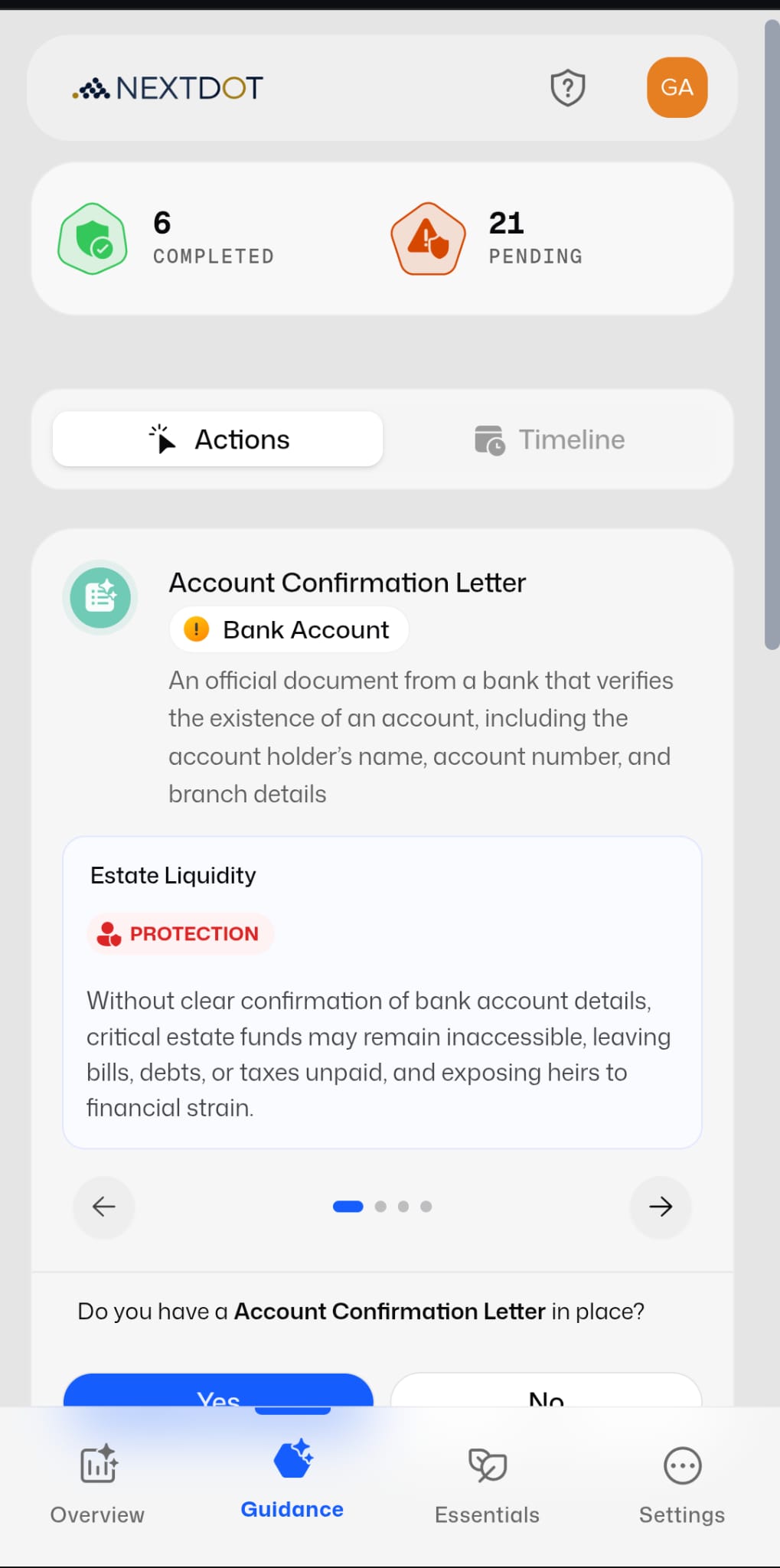

The Guided Path

For those who need clarity and direction

Step-by-Step Guidance

Like paint-by-numbers, follow clear instructions for each document

Detailed Explanations

Understand why each document matters with clear context

No Overwhelm

Focus on one action at a time, at your own pace

Perfect for: those feeling unsure, or anyone who wants comprehensive guidance

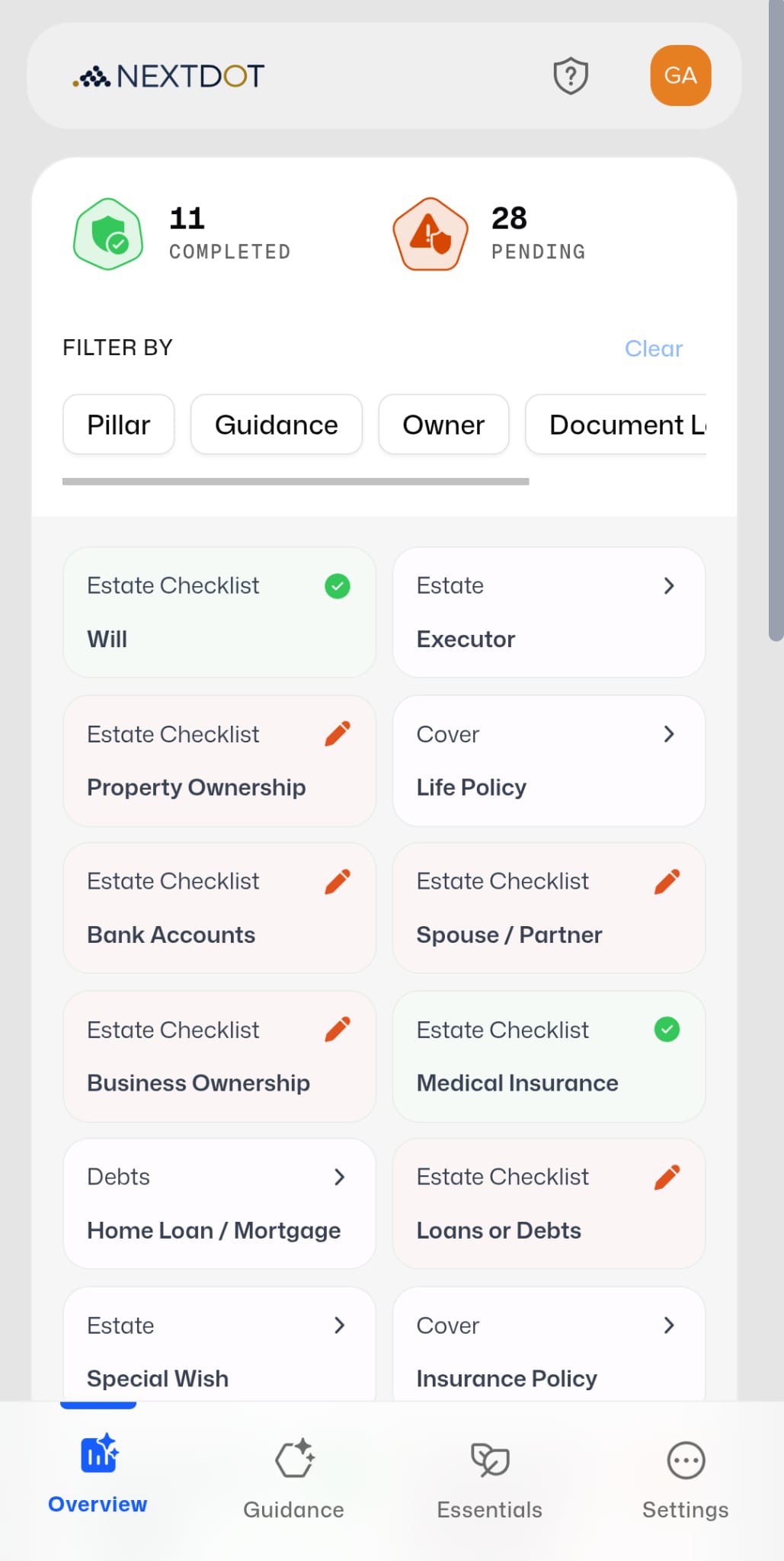

The Power User Path

For those who want to move quickly

Overview Dashboard

See all your tasks at a glance and tackle multiple items

Filter and Focus

Organize by pillar, owner, or document type for efficiency

Progress Tracking

Monitor completed vs pending items and move fast

Perfect for: Confident returning users, or those who prefer a bird's eye view

The Best Part? You Can Switch Between Both

Start with guided steps when you need clarity, then switch to the overview when you're ready to move faster. NextDot adapts to your needs at every stage of your estate planning journey.

Comprehensive estate planning made simple

Discover how NextDot guides you through every step of organizing your estate planning for your family's future

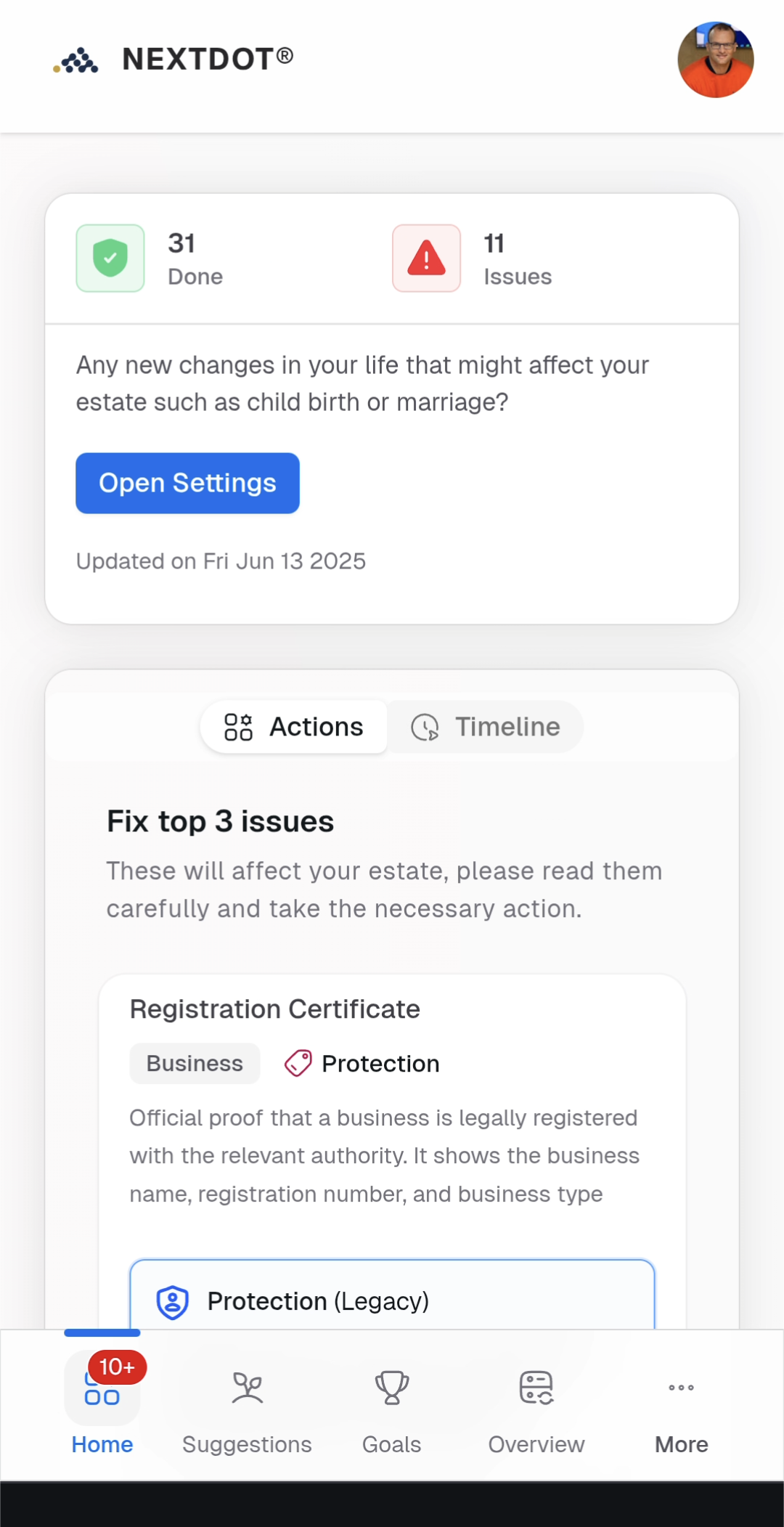

Home

Nudges allow you to store and record the next most important estate planning document, making these easy to find and manage.

"The best time to plant a tree was 20 years ago. The second best time is now."— Chinese Proverb

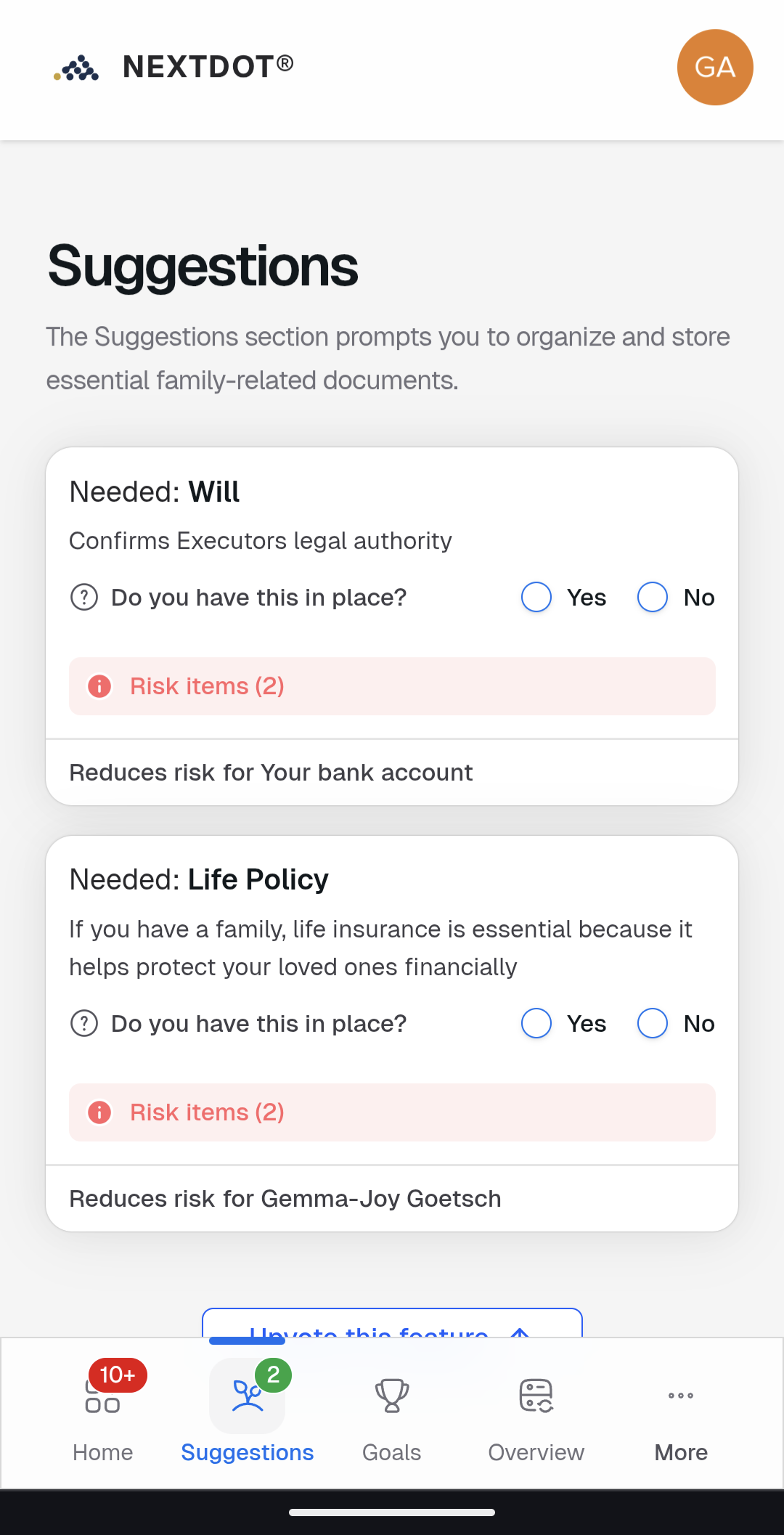

Suggestions

NextDot assesses gaps in your records and provides suggestions for you to consider as important action steps.

"An ounce of prevention is worth a pound of cure."— Benjamin Franklin

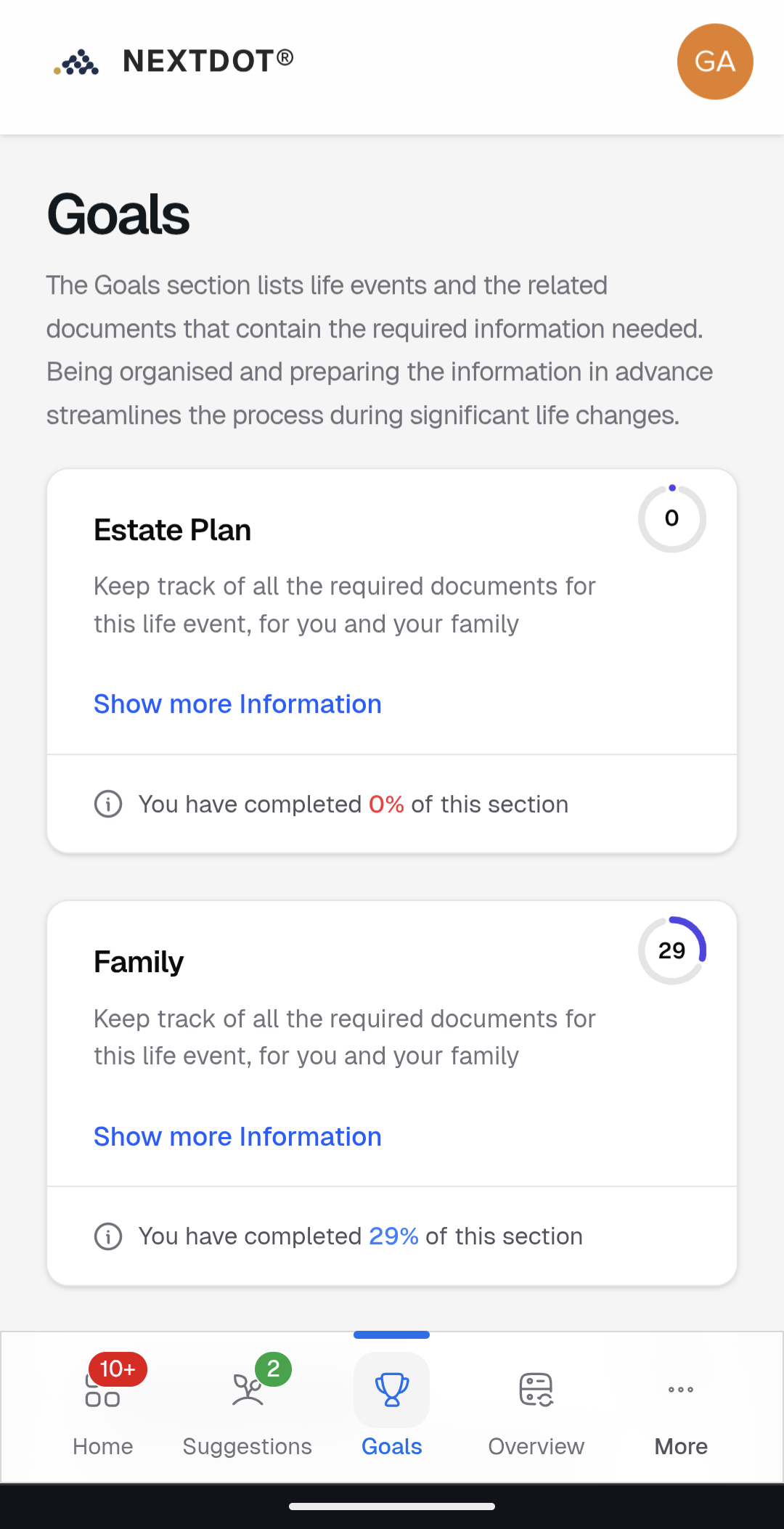

Goals

As you record documents, specific life event needs are completed - Goals provide your family with a view of these along your journey.

"A goal without a plan is just a wish."— Antoine de Saint-Exupéry

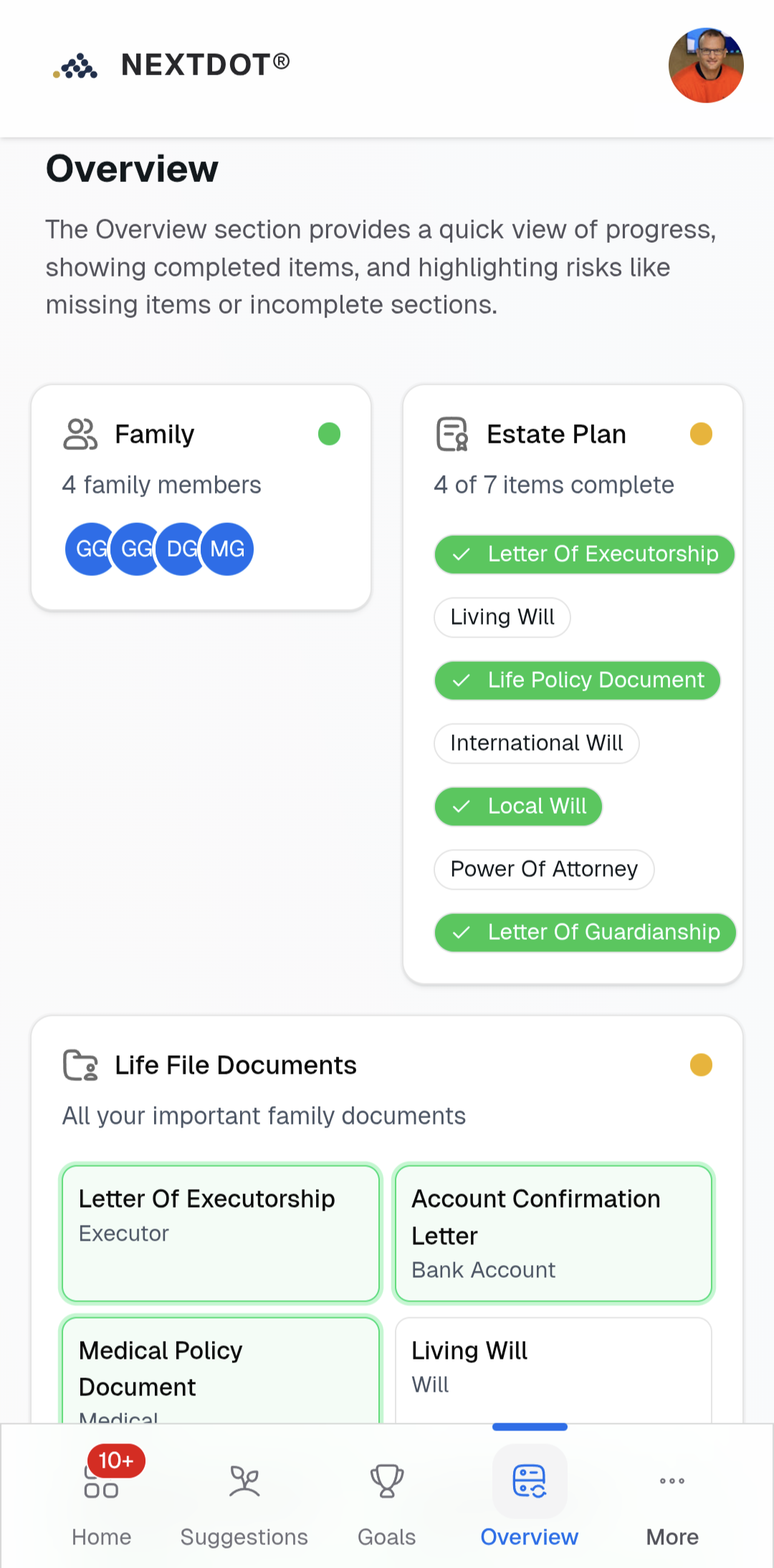

Overview

Stay on top of your estate planning progress with a visual dashboard.

"What gets measured gets managed."— Peter Drucker

What our families are saying

Real stories from families who have found peace of mind with NextDot

NextDot quietly solves one of life's most overwhelming problems - helping families like mine prepare for the unexpected with clarity, trust, and dignity. It's a rare product that feels both emotionally grounding and practically useful — meeting people where they are, and guiding them forward without friction.

NextDot User

Understanding the Importance of Estate Documents

Essential documents that protect your family and ensure your wishes are honored

Why it matters

It gives you control and peace of mind, knowing your family won't face uncertainty.

Why it matters

A good Executor ensures your wishes are followed without unnecessary delays or disputes.

Why it matters

It keeps your finances and decisions in trusted hands, so you're not left vulnerable.

Why it matters

It takes the guesswork away from your family during emotional times and ensures your values guide your care.

Why it matters

It ensures your money goes exactly where you want, quickly and without complications.

Why it matters

It gives you confidence that your kids will be in good hands, no matter what happens.

Why it matters

It saves time and reduces stress for your loved ones when settling your affairs.

Why it matters

It's a way to protect your family from financial burdens during a tough time.

Ready to secure your family's future?

Join thousands of families who have already organized their estate planning with NextDot. Start your free trial today and gain peace of mind.

No credit card required